Buy Now, Pay Later (BNPL) has officially entered the food delivery scene. DoorDash, the leading food and goods delivery app, announced a partnership with Swedish fintech Klarna to let customers finance their orders. In practical terms, this means that when ordering through DoorDash, you’ll soon see Klarna as a payment option at checkout. Users will be able to split the cost of purchases – whether it’s a weekly grocery haul, a retail item via DoorDash’s marketplace, or even the annual DashPass subscription – into smaller installments instead of paying the full amount upfront.

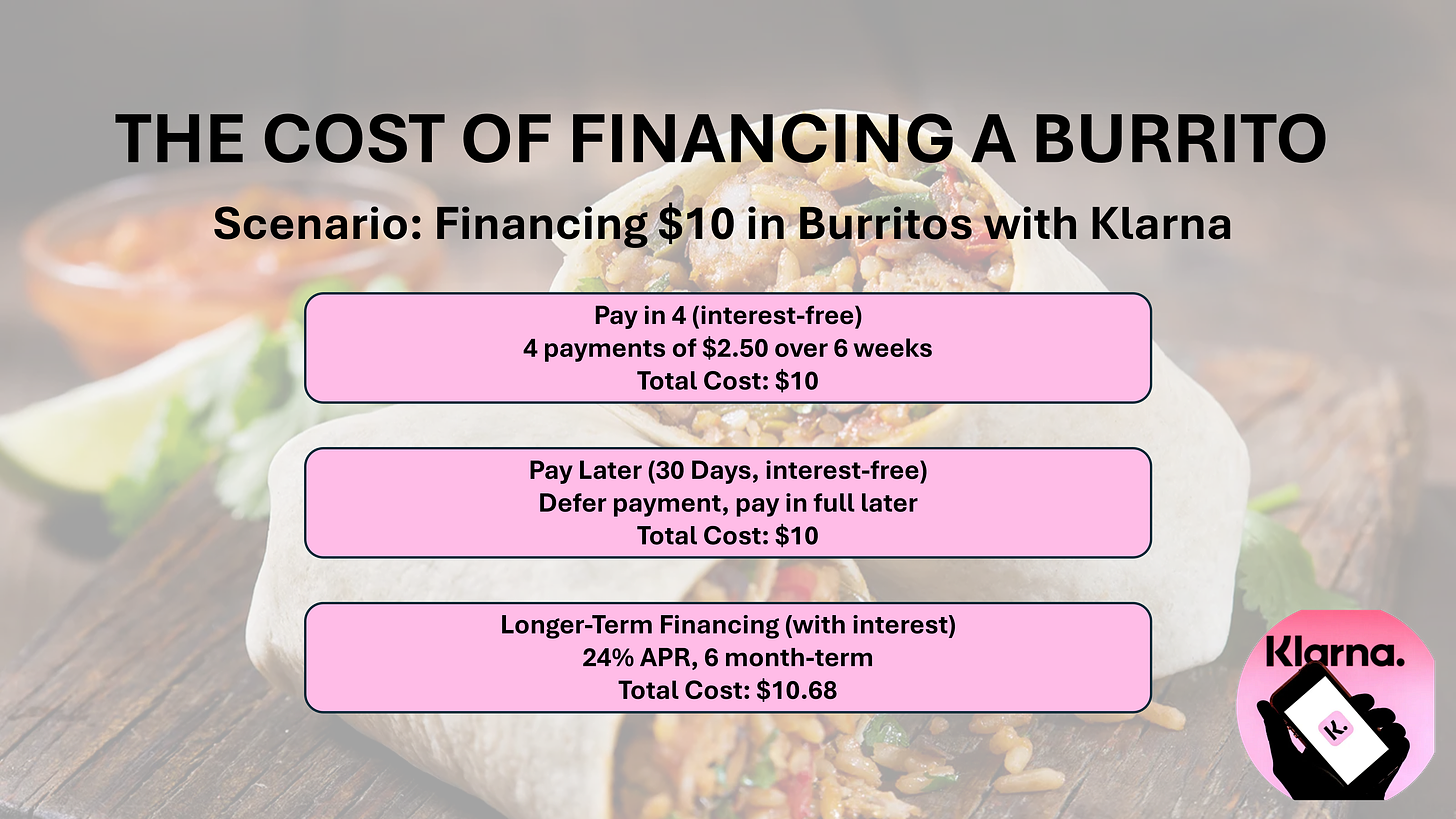

Under the partnership, DoorDash customers get three payment choices powered by Klarna’s BNPL service:

Pay in Full: The normal upfront payment (using Klarna’s interface for a “seamless” experience).

Pay in 4: Split the total into four equal, interest-free installments, paid over time.

Pay Later: Defer the payment to a later date (for example, aligning with your next paycheck) with no interest if paid within 30 days.

This isn’t the first time DoorDash has experimented with installment payments – the app previously integrated with Afterpay in 2022. However, Klarna’s integration brings a dedicated BNPL platform into the mix, potentially on a wider scale. DoorDash says this added flexibility will make convenience even more accessible for customers as it expands into categories like groceries, electronics, beauty, and gifts. In other words, financing might make more sense for a large grocery stock-up or a pricey gadget from a local store – not just that late-night taco craving (even though you could finance a burrito too).

Klarna’s Big Moves: IPO and the Walmart Deal

For Klarna, teaming up with DoorDash comes at an opportune time. The BNPL giant has been rapidly expanding its partnerships as it prepares for an initial public offering (IPO) in the U.S.. Just days before the DoorDash announcement, Klarna struck a major deal with Walmart’s fintech arm One (branded “OnePay”), positioning itself as Walmart’s exclusive BNPL provider. This was a significant win for Klarna, as it replaced rival Affirm – which had been Walmart’s installment loan partner since 2019 – in securing the exclusive spot (Affirm’s stock even tumbled on the news of losing the Walmart partnership). Klarna’s CEO hailed the Walmart deal as a “game changer,” framing it as a vote of confidence ahead of the anticipated IPO.

Between the high-profile DoorDash integration and the Walmart partnership, Klarna is boosting its U.S. presence in both e-commerce and everyday spending arenas. These moves are likely aimed at impressing investors by showing that Klarna can be “everywhere for everything,” from financing a new TV at Walmart to splitting the bill on tonight’s dinner delivery. And with the BNPL market becoming increasingly competitive, locking in big platforms like DoorDash and Walmart gives Klarna a stronger foothold as it enters the public markets.

DoorDash’s Massive Scale

DoorDash has grown into the world’s largest food-delivery service, processing roughly $80 billion in orders and subscription sales in 2024. This massive volume underscores why a partnership with DoorDash is such a big opportunity for any payment provider. Millions of people use DoorDash for everything from restaurant takeout to groceries, meaning Klarna’s BNPL features could quickly reach a wide audience. By teaming up with the delivery giant, Klarna gains access to DoorDash’s huge customer base and order flow, integrating its payment plans into purchases that people make on a daily basis.

It’s worth noting that DoorDash’s business isn’t just burritos and burgers these days. The company has broadened into delivering groceries, convenience items, and retail products – even adding services like DoorDash Drive and DashMart. In that context, offering installment payments through Klarna could appeal to customers making larger purchases via delivery (think a big Costco order, or an electronics splurge) rather than someone financing a single cheeseburger. DoorDash, for its part, continues to dominate U.S. delivery market share and grow its total order value, even though it only recently achieved its first profitable quarter. By partnering with Klarna, DoorDash can entice cost-conscious customers with more payment choices, possibly driving even more orders on the platform.

Should You Finance Your Burrito?

The announcement inevitably begs the question: Would you use BNPL for takeout or groceries? Proponents argue that giving people more flexibility at checkout is a good thing – it can help in a pinch or allow someone to order needed items before payday. For example, a family might split a $200 supermarket delivery bill over multiple pay periods, easing their cash flow. Klarna and DoorDash pitch the partnership as empowering customers with “choice and control” in how they pay, aligning with a broader trend of flexible payments in everyday shopping.

However, the idea of financing a burrito (or any fast food meal) has struck many as overkill. The concept quickly drew some mockery on social media. Critics point out that if you need a short-term loan to buy a takeout dinner, maybe that delivery habit is doing damage to your wallet. After all, food delivery already comes with hefty mark-ups and fees – stretching out payments might just mask the sticker shock while encouraging overspending. Personal finance gurus (like radio host Dave Ramsey, known for advising against debt) have been cited as likely to cringe at the thought of people opting to “buy now, pay later” for a Taco Bell run.

There are also broader financial concerns with applying BNPL to small, frequent purchases. The ease of splitting payments can lead to losing track of how much you’ve racked up in total. If someone starts financing everyday expenses, they could end up juggling multiple installment plans on top of credit cards, creating a slippery slope of debt. It doesn’t help that U.S. consumers are already dealing with record-high credit card debt – over $1.2 trillion as of late 2024. Adding takeout bills to the mix of “buy now, pay later” obligations might further stress those who are living paycheck to paycheck. And while Klarna’s Pay in 4 is interest-free, missing payments can incur late fees, and the “Pay Later” longer-term loans (like those in the Walmart One pay program) can carry interest.

Bottom line: Financing your burrito is now technically possible, but it isn’t necessarily a habit financial advisors would endorse. If used responsibly, BNPL for delivery could provide a bit of breathing room on a tight budget or let you manage a large purchase more comfortably. Yet, for non-essential splurges (like that midnight burrito with extra guac), splitting it into four payments might be a sign to double-check your spending choices. As with any BNPL offer, moderation and careful budgeting are key. Just because you can pay for your sushi order in installments doesn’t mean you should – at least not unless you truly need to.

So, what do you think? Is BNPL for takeout a convenient innovation, or a step too far in our buy-now-pay-later culture? The answer may depend on whether that next burrito is a treat-you-deserve or a debt-you-regret. Let me know your thoughts below!

Sources: Klarna & DoorDash press release via StraightArrow News (DoorDash introduces 'Buy Now, Pay Later' option via Klarna) (DoorDash introduces 'Buy Now, Pay Later' option via Klarna); Digital Transactions (Mar 2025) (Walmart’s Decision to Oust Affirm in Favor of Klarna Unlikely to Significantly Harm Affirm’s Business – Digital Transactions); Entrepreneur (Mar 2025) (Klarna Becomes Walmart's Exclusive Buy Now, Pay Later Option | Entrepreneur); Marginal Revolution Univ. (News Articles and Media: Costs of Production | Marginal Revolution University); StraightArrow News – consumer debt data (DoorDash introduces 'Buy Now, Pay Later' option via Klarna).